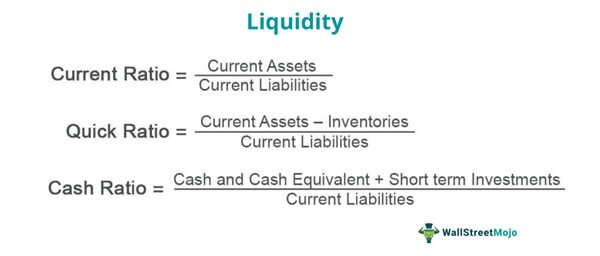

Liquidity Ratios Guide: Types, Formulas and Examples

Credit institutions shall ensure that the currency denomination of their liquid assets is consistent with the distribution by currency of their net liquidity outflows. Credit institutions shall have ready access to their holdings of liquid assets and be able to monetise them at any time during the 30 calendar day stress period via outright sale or repurchase agreement on generally accepted repurchase markets. A liquid asset shall be deemed readily accessible to a credit institution where there are no legal or practical impediments to the credit institution’s ability to monetise such an asset in a timely fashion.

The Current Ratio

In the stock market, brokerage firms act as intermediaries facilitating trading and lending of securities on behalf of clients. One of their key risks is liquidity risk – the risk of not having enough liquidity reporting contingent liabilities to fulfill client orders or borrowing demands. An LCR below 100% implies that the brokerage does not have enough liquid buffers to handle sudden client withdrawals or margin calls under stress.

Article 30 Additional Outflows

The liquidity ratios deal with the relationship between such current assets and current liabilities. This implies that the company has $0.90 of cash for every $1.00 of its total current liabilities (also known as a working capital requirement). The higher the cash ratio, the better for the company since it has sufficient liquid assets to pay off its short-term obligations such as trade payables and short-term loans.

Example of the Cash Ratio

Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. Liquidity ratio analysis may not be as effective when looking across industries as various businesses require different financing structures. Liquidity ratio analysis is less effective for comparing businesses of different sizes in different geographical locations. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader.

Business Cycle

Current assets include cash, marketable securities, accounts receivable and inventories. Current liabilities include all short-term liabilities, i.e. those that have to be paid within one year or less. Liquidity Ratios are essential for evaluating a company’s ability to fulfill short-term financial obligations and offer insights into its fiscal health.

- This indicates a need for Reliance to continue monitoring and potentially improving its short-term debt management.

- A lower DSO indicates an efficient collection process, while a higher DSO signifies slower payment.

- It means the company is struggling with liquidity, and its precarious financial position leaves little room for flexibility in the face of economic downturns, unexpected costs, or loss in sales.

- Liquidity ratios are a financial metric that measures a company or an individual’s ability to meet short-term debt obligations.

Would you prefer to work with a financial professional remotely or in-person?

Liquidity ratios are essential financial metrics that help investors, creditors, and financial analysts assess a company’s ability to meet its short-term obligations. These ratios measure a company’s financial health and indicate the ease with which it can convert assets into cash to pay off liabilities. The cash ratio is seldom used in financial reporting or by analysts in the fundamental analysis of a company. It’s not realistic for a company to maintain excessive levels of cash and near-cash assets to cover current liabilities. It’s often seen as poor asset utilization for a company to hold large amounts of cash on its balance sheet because this money could be returned to shareholders or used elsewhere to generate higher returns.

Investors should keep in mind that it shows only a snapshot, not ongoing liquidity management. The net debt ratio measures a company’s leverage and ability to pay all its debts with its assets. It compares a company’s total debt to its total assets to show how leveraged it is. Total assets encompass current assets and long-term assets like property, plant, and equipment. Liquidity concerns the short term, and liquidity ratios are obtained from the current portion of assets and liabilities.

Collateral in assets referred to in Article 10(1)(f) which is posted by the credit institution for contracts listed in Annex II of CRR and credit derivatives shall be subject to an additional outflow of 10%. Credit institutions shall report to their competent authority the liquidity coverage ratio in accordance with Reporting (CRR) Part of the PRA Rulebook. Credit institutions shall maintain a liquidity coverage ratio of at least 100%. A company may be inefficient in managing cash and leveraging low credit terms. It may be advantageous for a company to reduce its cash ratio in these cases.

The liquidity provision is measured using Amihud’s Illiquidity measure which is a proxy for measuring illiquidity. The liquidity measure is examined for chosen 8 stocks based on their market capitalization. The volume of algorithmic orders is examined using the Limit Order Book (LOB) data obtained from the BSE and orders for 23 trading days have been considered. We observe that large capitalization stocks display higher liquidity and algorithmic traders are able to contribute significantly to liquidity when compared to non-algorithmic traders. It was also looked at if there was a big difference in the amount of algorithmic trading done on stocks with big and small capitalization. Differences in accounting policies and reporting standards across companies and industries can lead to inconsistencies in liquidity ratios, making comparisons difficult.